Posted by Janine Griffiths

What is an immediate needs annuity?

Thinking about care can feel like stepping into a world of unknowns. There are so many different terminologies and financial products to get your head around. On top of that, the timing is often urgent, and the costs? Well, they can be more than a little daunting. For many people reaching their later years, the biggest worry isn't just about finding the right care, it's about figuring out how to afford it, both now and in the long run.

Let’s be honest: care isn’t cheap. Whether you’re considering support at home or a move into a residential care setting, the bills can quickly add up. And what makes it harder is the unpredictability. How long will care be needed? How will the costs change over time? These are the kinds of questions that keep families awake at night.

It's natural to worry about what this means for your savings. Will they last? Will your loved ones be left with financial burdens? And for many, there's a quiet but persistent question in the background: is there a way to protect the family home or preserve something to pass on?

The good news is, you're not entirely at the mercy of the unknown. There are financial options designed to help bring more certainty to this stage of life. One of these is something called an immediate needs annuity. It’s a type of product that can turn a one-off payment into a regular income that covers care costs and it can offer a sense of financial security just when it’s needed most.

In a world where care costs feel like a moving target, an immediate needs annuity is one way to take back a little control.

What exactly is an immediate needs annuity?

So, you’ve heard the term immediate needs annuity and maybe thought, “that sounds complicated.” But don’t worry - it really isn’t. In fact, it’s designed to make life simpler when care becomes a pressing need.

An immediate needs annuity is a type of insurance product that does one very important thing: it guarantees a regular income to cover care fees for the rest of your life. That income is paid directly to your care provider and, when set up correctly, it’s partially tax-free. The part that just gives you back your original money (your lump sum) is tax-free. But any extra amount that counts as interest or profit is taxed as income. It's one of the few ways to turn a lump sum of money into a predictable, reliable way to pay for care, month in, month out.

Let’s break it down a bit. The word “immediate” is exactly what it sounds like. The payments begin straight away - no waiting period, no delay. This is key if care is needed urgently and the bills have already started coming in.

Then there’s “needs.” This means the annuity is specifically for people who have been medically assessed as requiring care now, not at some point in the future. It’s not for planning ten years ahead. It’s for situations where the need is real and current.

The whole idea behind an immediate needs annuity is to take the unpredictability out of care costs. It gives you and your family the peace of mind that, no matter what happens next, those essential fees will be covered. No more wondering how long your savings will last. No more monthly juggling. Just a bit more certainty in an uncertain time.

How does an immediate needs annuity work?

If the idea of handling monthly care bills feels stressful or uncertain, an immediate needs annuity could offer a much-needed sense of relief. Right from the start, it’s designed to simplify things and that’s something many of us can appreciate when life already feels complicated enough.

So how does it actually work? The concept is surprisingly straightforward. You begin by paying a one-off lump sum to an insurance provider. This sum is based on a few factors, like your age, health, and the level of care you need. In exchange, the insurer guarantees to pay a regular income straight to your chosen care provider.

This income starts almost immediately and continues for as long as you need care. Best of all, if the payments are made directly to a registered care provider, they’re almost always tax-free. That means more of your money is going exactly where it’s needed, without being whittled away by tax.

What makes an immediate needs annuity appealing is the clarity it brings. There's no need to keep track of fluctuating fees or worry about running out of funds month by month. The care costs are taken care of, and that can lift a significant weight from your shoulders.

In short, it takes something uncertain such as the cost of future care and replaces it with something steady and dependable. And when you're trying to focus on wellbeing, that kind of predictability can be invaluable.

How much does an immediate needs annuity cost?

If you're considering an immediate needs annuity, one of the first questions that naturally comes to mind is: how much does it cost? It's a sensible question, and the honest answer is that the cost can vary quite a bit depending on your personal circumstances.

Several factors come into play when working out the price. Your age is a big one, as is your overall health and life expectancy. The insurance provider will also consider how much income you need each year to cover your care costs, and whether that income should increase over time, either with inflation or at a fixed yearly rate. This helps keep up with rising care fees in the future, which can provide peace of mind but will affect the initial cost.

Current annuity rates also make a difference, much like how interest rates affect savings accounts. These rates change over time and can influence how much regular income the lump sum will buy you.

You might also choose to pay extra for something called a capital protection clause. This means that if care is only needed for a short time, some of the original lump sum can be returned to your estate. It adds a layer of reassurance for some people, although this option does increase the cost of the annuity.

Ultimately, an immediate needs annuity is tailored to you. It's not a one-size-fits-all product, which means the price is personal, just like your care journey. Getting a quote through a qualified financial adviser is the best way to find out what it might cost in your situation, and whether it’s the right fit for your needs and your finances.

Is an immediate needs annuity right for you?

Choosing how to fund care can feel like navigating a maze, especially when decisions need to be made quickly. An immediate needs annuity is one option that can bring stability during a time of uncertainty, but like all financial products, it won’t be the right fit for everyone. So how do you know if it’s something worth exploring?

When an immediate needs annuity might be right for you

An immediate needs annuity could be a good choice if you’ve already been assessed as needing care now, and you want the reassurance that your care fees will be covered for the rest of your life. It can remove the stress of monthly budgeting and reduce the risk of your savings being gradually eroded by care costs. It also offers peace of mind for families, knowing that care can continue without sudden financial strain.

It may also appeal if you have a lump sum available, perhaps from selling a home or downsizing and want to turn that into a guaranteed income for care. The predictability of the payments can be a comfort in what is otherwise a very unpredictable time.

When an immediate needs annuity may not be suitable

On the other hand, this type of annuity may not be right if your care needs are still uncertain, temporary, or only just beginning. It’s designed for people with established, ongoing care needs. Because it involves paying a significant lump sum up front, it might also feel like too big a commitment if your situation could change, or if you’d prefer to keep your financial options more flexible.

It’s also worth remembering that once the annuity is in place, it can’t be adjusted later. So if you prefer financial solutions that allow you to make changes over time, this might not align with your preferences.

In the end, it’s about finding what works best for you and that starts with understanding all the options. Speaking to a regulated adviser can help make the decision clearer and give you the confidence to move forward with care and comfort in mind.

Pros and cons of an immediate needs annuity

If you're looking into an immediate needs annuity, you're probably hoping to bring some peace of mind to a situation that feels anything but peaceful. It can be reassuring to know that your care costs might be covered for life, but like all big financial decisions, it’s important to weigh up the good with the not-so-good.

The advantages of choosing an immediate needs annuity

One of the biggest benefits is certainty. Once the annuity is set up, it guarantees your care fees will be paid for as long as you need care. This removes a huge layer of stress — not just for you, but for your family too. No one has to worry about where the money will come from next month, or whether savings are draining faster than expected.

There’s also a tax advantage. If the income is paid directly to a registered care provider, it’s typically partially tax-free. That can make a meaningful difference to how far your money goes. And because care costs are covered, any remaining savings or assets you have may be better protected, which could be important if you want to leave something behind for loved ones.

Things to think twice about

That said, an immediate needs annuity isn’t without its downsides. The most obvious is the upfront cost. You’ll need to pay a lump sum at the beginning, and depending on your age, health, and care needs, it can be significant.

It’s also important to understand that this type of annuity is non-refundable. If your care needs change or come to an end sooner than expected, you usually can’t get the money back. There are some options, like capital protection, to manage that risk — but they come at an extra cost.

Finally, once the annuity is in place, it’s fixed. You can’t change the terms later on. So if flexibility is something you value, that could be a drawback.

In short, there are clear benefits, but also real considerations. That’s why getting independent, regulated advice is so important. It helps ensure you make a decision that’s right for your care, your finances, and your peace of mind.

How can Autumna help?

If you are looking for free tips from a caring and knowledgeable team, feel free to get in touch on 01892 335 330 and our team can point you in the right direction.

Use the search bar on our website to search for care providers within your budget. Simply choose the type of care you need and enter your location. Our system will then display a list of providers in your chosen area.

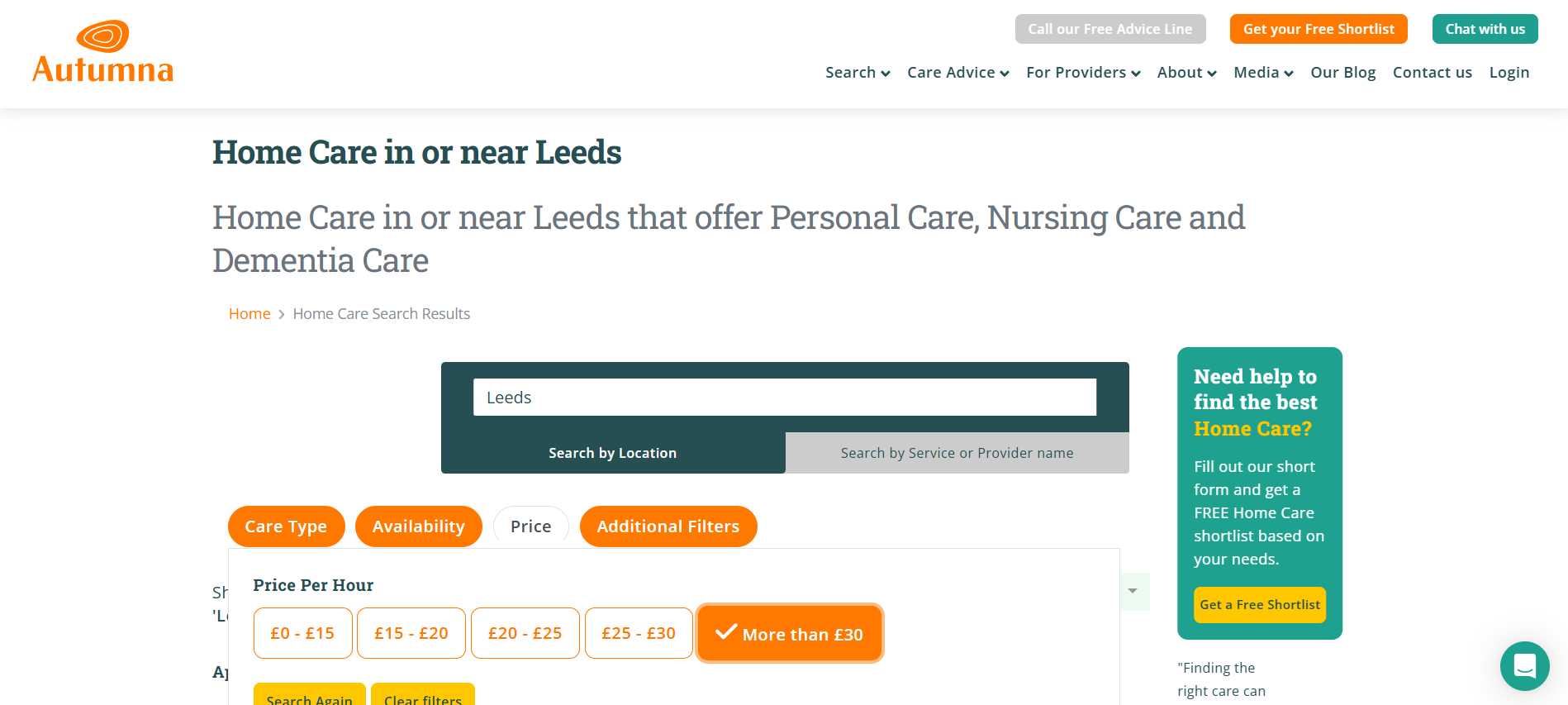

You can also use the filters at the top of the search results to narrow down options by price. The "Price" tab lets you set a weekly budget. Once you have selected your price, press the yellow search again button.

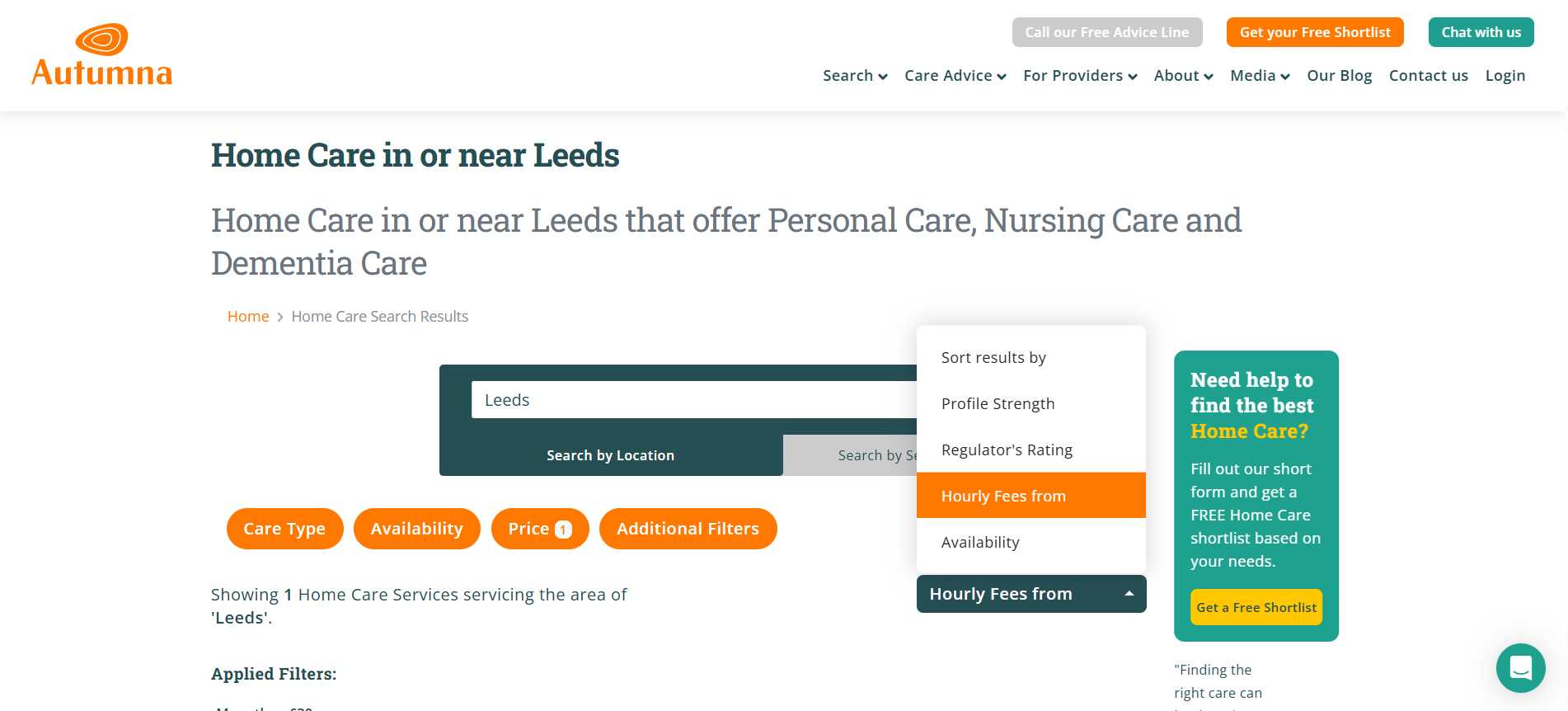

You can also sort care homes from lowest to highest cost.

Alternatively, our platform can do all of the searching for you. All you need to do is head over to our shortlisting tool, enter your details and the system will generate a more personalised list of providers that are closely matched to your requirements.

While no one can predict the future, an immediate needs annuity offers something rare: financial clarity at a time when life feels uncertain. If you're facing care decisions now and want to feel more in control, this option might be worth exploring - not just for peace of mind, but for the comfort it brings to those around you too.

Receive a Free Care Provider Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care providers! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Care options for the elderly: What is right for you?

October 17th, 2025

Discover care options for the elderly that fit your needs, from home support to residential care, helping you plan confidently for the years ahead.

Older Persons Care Advice

How to find a live in carer

October 15th, 2025

Discover how to find a live in carer who’s skilled, trustworthy and compatible, with practical tips on choosing the right support for your needs.

Older Persons Care Advice

Top day centres for the elderly in Kent

October 10th, 2025

Discover top day centres for the elderly in Kent offering companionship, activities, and flexible support to help loved ones stay active and fulfilled.

Frequently Asked Questions

Yes, the income from the annuity is usually paid directly to a registered care provider of your choice. However, it's important to confirm this with the provider and ensure they are properly registered to maintain tax-free benefits.

Most immediate needs annuities are portable, meaning the payments can continue to a new registered care provider. But you should always check the policy terms to be sure.

Yes, some people choose to release equity from their home to fund the annuity purchase. However, this is a major financial decision and should be discussed with a regulated adviser to weigh up the pros and cons.