Posted by Laura Sheath

How Much do Pensioners Need a Year to Retire?

£31,000 a year - but women are falling short.

New data from The Pensions and Lifetime Savings Association (PLSA), a body of people who aim to help everyone achieve a better income in retirement, shows the stark difference between the retirement pots of older men and women in the UK.

Men, on average, save £205,000 for their retirement but typically have a shorter life expectancy of 79. In contrast, women save just £69,000 yet on average, live to 83.

This monumental difference in retirement income affects the quality of care that older women receive, with less money to allocate towards necessities like heating, nutritious food or care.

But what’s the solution, and is there any funding help available for older women and men that could contribute towards their retirement and cost of care?

A girl would need to start saving for a pension at just three years old

To close the gap and start retirement with the same prospects, a girl would need to save for a pension before she had even started school, according to research from NOW: Pensions in partnership with the Pensions Policy Institute (PPI).

Joanne Segars OBE, Chair of Trustees at NOW: Pensions said, “Our research is an important step in identifying, defining, and addressing the problem and what we can do as a society to fight for fair pensions for all.”

A separate report by the Pensions Policy Institute has suggested that, typically, women would have to work the equivalent of 19 additional years to match the savings of men.

The full state pension rises to £11,541.90 for men and women as of April 2024 and that’s great news however, it would seem that the ability to save additional money to fund a moderate retirement is stunted depending on your gender.

Why is there such a difference in retirement savings between men and women?

- Women who have children have to choose between raising their children and having no income or paying someone else for childcare so that they can work.

- The UK has the third highest childcare costs in the world – it’s unsustainable and is forcing women out of work because they simply cannot afford it.

- The average salary doesn’t cover the typical cost of rent plus full-time nursery care, says the ONS, so that results in less money to save for retirement.

- Women typically earn less and don’t always meet the automatic enrolment earnings threshold for a workplace pension.

A 2023 report called Careers after Babies also found that:

- 5% of women are made redundant while on maternity leave, compared to 0.3% of the rest of the population annually.

- 11% of women are forced to be stay-at-home mums when only 2% would be out-of-choice.

- 14% of women choose to become freelancers for the flexibility they need but lose out on job security, pay and other employment benefits such as pension contributions.

It’s not that women don’t want to work

Data from the Office for National Statistics, shows 75.6% of mothers with dependent children in the UK are in work, which is the “highest level in the equivalent quarter over the last 20 years”.

The problem is that while their male co-workers work on average for 5 days a week, 86% of women feel that they can only work 3 days a week. That results in a lower income and a lower pension contribution.

How much do pensioners need for their retirement?

The Pensions and Lifetime Savings Association (PLSA) worked with the Centre for Research in Social Policy at Loughborough University to create three categories to differentiate the income needed for a minimum, moderate or comfortable retirement.

A single person during retirement would need:

- £14,400 a year for a minimum income

- £31,300 a year for a moderate income in retirement

- £43,100 a year for a comfortable retirement

A couple during retirement would need:

- £22,400 at the minimum level

- £43,100 at a moderate level

- £59,000 at a comfortable level

What’s considered a moderate retirement?

Discussion groups considered that at the moderate level of retirement, people should be able to:

- have a monthly meal out with their loved ones

- help their family members financially with a budget of £1,000

- help with grandchildren's activities

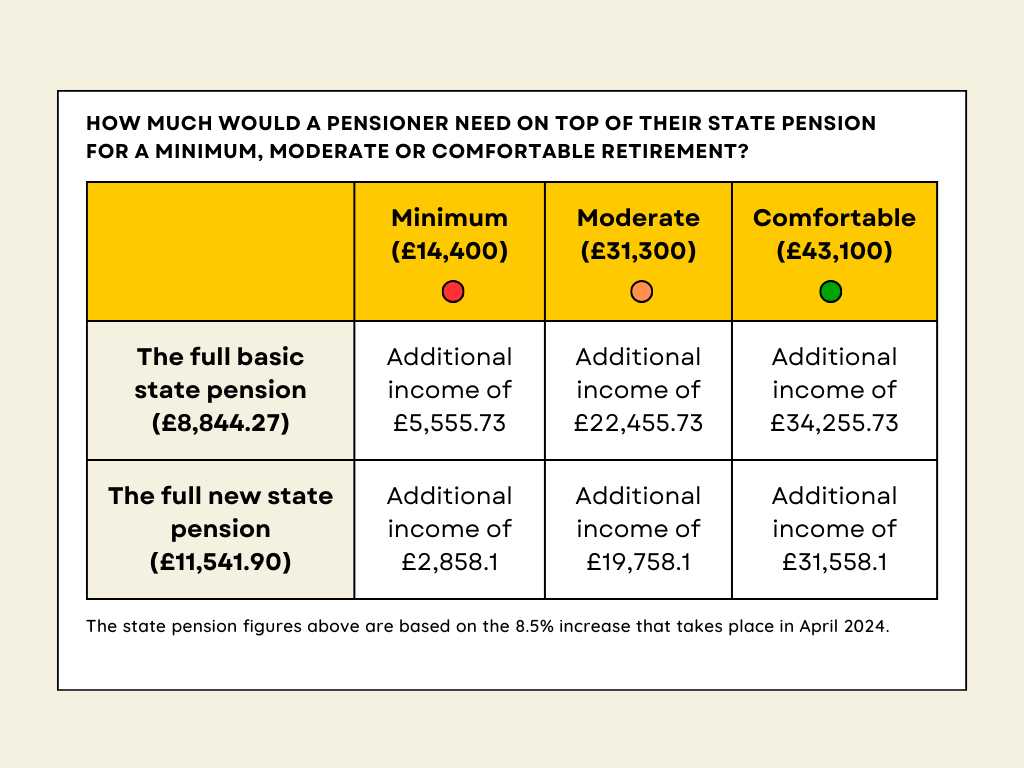

How much would a pensioner need on top of their state pension?

The table below shows how much a single pensioner, either a man or woman would need to contribute a year on top of their state pension to have either a minimum, moderate or comfortable retirement.

How does life expectancy affect how much people need to retire?

The average life expectancy for men in the UK is 79, whereas women typically live longer, with an average life expectancy of 83 years.

To accommodate for the difference in life expectancy, women need to have enough retirement income to last on average 16 years from the age they retire (67) whereas men would need to have enough retirement funds to last them on average 12 years.

That would mean that to experience a “minimum” retirement, women receiving the full new state pension would need to contribute £88,891.68 during their retirement, either through savings, equity release, downsizing or benefits and allowances.

However, data from Now Pensions and the Pensions Policy Institute has suggested that women retire on average with pension savings of £69,000, compared with £205,000 for men.

What’s the average cost of care in the UK?

The cost of care is a factor that everyone should consider when planning their retirement and calculating how much they'll need.

Many older adults have no intention of needing care because they’re physically and mentally well; however sudden changes in health can affect needs and can consequently have an impact on budget and disposable income in retirement.

The cost associated with care, whether at home or in purpose-built accommodation, can vary massively depending on where you live in the UK and the level of assistance required.

Care homes: The average weekly cost of living in a residential care home is £760, while the average nursing home cost is £960 per week across the UK. The monthly average price of residential care is £3,290 and receiving nursing care in a care home costs an average of £4,160.

Home care: The average hourly cost of a home carer based on Autumna data is £22/£23 an hour. So, if someone were to have an hour of home care assistance every day, that would equate to £161 a week, £699 a month or £8,395 a year.

Live-in carer: In the UK, permanent live-in care costs around £228 per day. This comes to £1,596 a week, £6,916 a month and £82,992 a year.

Retirement Living: The average property price for a retirement living apartment varies depending on the level of care and services provided, the number of bedrooms and the location of the development. As an example, in the South East, the average cost of buying a one-bedroom retirement living apartment is £342,900. Service charges are typically charged on top of this, usually weekly or monthly and again, these vary between developments.

Are there any benefits or allowances that pensioners can apply for to top-up their retirement income?

Yes, depending on whether they meet the eligibility criteria, older adults whether male or female may be eligible for help with funding or benefits including:

- Attendance Allowance

- Carer’s Allowance

- Personal Independence Payment (PIP)

- Disability Living Allowance

- Pension credit

Pensioners who are categorised as self-funders might not be aware that they could be eligible for the benefits listed above, including Personal Independence Payment. PIP is an example of a benefit awarded to people with an ongoing illness or disability that can be used to pay towards the cost of care.

Talk to Autumna about your retirement plans

Our elder care experts can assist you with questions regarding planning, finding and paying for care.

Autumna lists over 26,000 care providers and is the most detailed care directory in the UK. You’re welcome to call for free advice, 7 days a week on 01892 335 330.

You can also request a shortlist of care options to be sent to your email for free.

Need some help finding care services or retirement properties?

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of options! Click the button below to begin, it takes just a few minutes.

Other helpful services

- Citizen’s Advice: Call 0800 144 8848

- Pension Wise: Call 0800 011 3797

- Government Pension Service: 0800 731 0469

Other articles to read

From the blog

Older Persons Care Advice

Importance of person centred values in care

July 4th, 2025

Looking for care that truly puts you first? Discover why person centred values in care matter and how to find services that treat you like a person, not a task.

Older Persons Care Advice

How the assisted dying vote affects end of life care

July 3rd, 2025

What does the assisted dying vote mean for care, choice and dignity at the end of life? Discover what’s changing, and how it could affect your future.

Older Persons Care Advice

Winter Fuel Payment Eligibility review: What’s changed in 2025?

July 2nd, 2025

Confused by the 2025 Winter Fuel Payment eligibility review? Discover who still qualifies, what’s new, and how to make sure you’re not left out in the cold.