Posted by Janine Griffiths

Guide to tenants in common care home fees

Planning for care later in life often feels like navigating uncharted waters. When you've spent decades in your family home, the thought of how to protect it while securing quality care can be overwhelming.

There’s so much information out there, and when it comes to finances, it’s no wonder that things can get confusing.

One area many people find themselves wondering about is tenants in common care home fees - specifically, how owning a home this way might affect what you pay if you ever need residential care. It’s a fair question and one that deserves a clear, straightforward answer.

That’s exactly what this guide aims to do. We’ll take you through the essentials gently, explaining what you need to know without the legal jargon. Whether you’re thinking about the future or planning right now, you deserve to feel confident in your choices. Let’s start by breaking it down together.

What does tenants in common mean for care seekers?

If you’ve come across the term tenants in common, you might be wondering what it actually means and more importantly, how it affects you or your family when thinking about care.

Let’s start with the basics. In the UK, if you own a home with someone else, there are usually two ways that ownership is legally structured: joint tenants or tenants in common. While the names sound similar, they work quite differently and that can make a big difference when care fees are assessed.

When you own a home as joint tenants, both people own the whole property together. If one person passes away, the other automatically inherits their share. There’s no division, and the home is treated as a single, joint asset.

But with tenants in common, each person owns a separate share of the property. These shares can be split evenly, or in different proportions depending on what’s been agreed. Crucially, each person can decide who inherits their share in their will. It’s this division that can come into play when local authorities carry out a financial assessment for care.

Think of it like slicing a cake. With joint tenancy, you both own the entire cake. With tenants in common, each person owns their own slice. And when care fee assessments come around, it’s just your slice that’s on the table.

How does tenants in common affect care home fees?

In simple terms, when it comes to care home fees, the council looks at your share of the property – not the whole house – if you’re a tenant in common. However, the value of the property may still be disregarded in the means test if a spouse or qualifying relative is still living there, regardless of whether the property is owned as joint tenants or tenants in common.

This means that, for care fee assessments, both ownership structures can offer protection if a relative continues to live in the property. The council will typically disregard the property value when assessing care fees, which provides a level of protection for the person in care, so long as the spouse or relative remains living there.

However, there are nuances to consider. For example, if one co-owner enters a care home, the value of their share of the property might be included in the means test, depending on the circumstances.

Can tenants in common really protect your home from care fees?

Many people hope that becoming tenants in common will shield their home from being used to pay for care. It’s a comforting thought, especially when you’ve worked hard for your home and want to keep it in the family. However, as is the case with joint tenancy, this arrangement alone isn’t a guaranteed safeguard. If the local authority believes you’ve made changes purely to avoid paying for care, they may view it as a deliberate deprivation of assets. In that case, your home could still be counted in a financial assessment regardless of who is living there.

Tenants in common can be part of a thoughtful plan to protect your assets and inheritance, but it’s not a magic solution. It’s always worth seeking advice to ensure your intentions are clear and your choices are protected.

What local authorities really look at when assessing care fees

Understanding how care fees are calculated can feel a bit like deciphering a secret code. But once you know what local authorities are actually looking for, it becomes much easier to feel in control of the process.

When someone applies for help with care home costs in the UK, the local authority carries out what’s called a means test. This simply means they assess how much money you have, including income, savings and property, to work out what you can afford to contribute towards your care.

If you own your home, it’s likely to be considered in this assessment. But if the property is owned as tenants in common, the council will usually only look at your individual share, rather than the full value of the home. That can affect how much is counted as part of your assets.

This is why knowing how your home is owned matters. It doesn’t just shape your will or future plans, it can directly influence what support you might be entitled to if you need care.

Planning ahead with confidence and care

Ultimately, care planning isn’t just about reacting when the time comes. It’s about getting ahead of things, asking the right questions, and feeling confident in the decisions you’re making. Every person’s situation is different, and what works well for one family might not be right for another.

That’s why it’s always worth speaking to professionals such as solicitors, financial advisors, or care funding specialists about tenants in common care home fees. They can help you navigate your options based on your unique circumstances. You don’t need to figure it all out alone.

The earlier you start the conversation, the more freedom you have to shape the future in a way that reflects your values and protects the things that matter most.

Looking for a care provider?

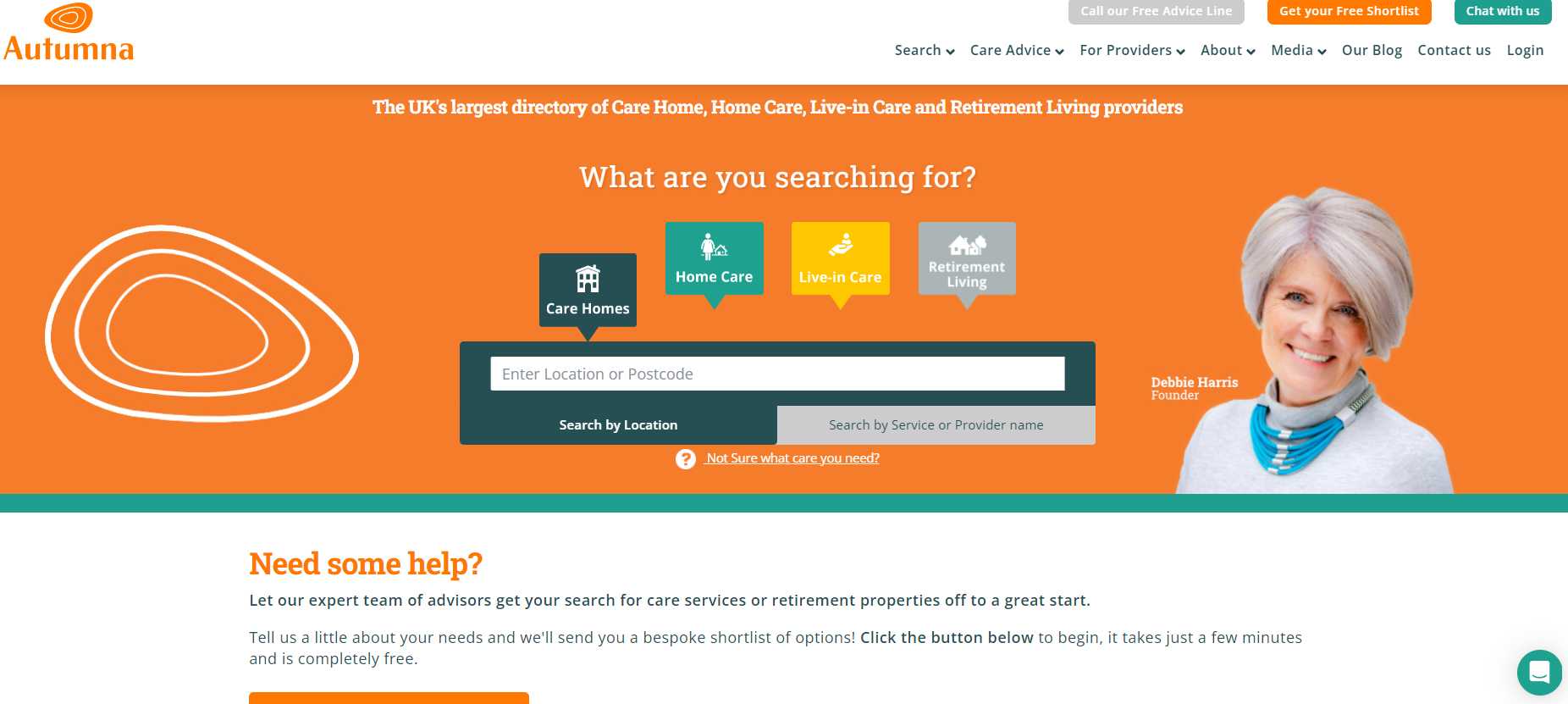

If you are searching for a care provider, Autumna can help. Simply head over to our homepage and choose the type of care you need.

You can then type in your location and press enter to see a list of providers in your area. Alternatively, our shortlisting tool can help you find an even more personalised list of care providers. Feel free to contact our friendly and knowledgeable team of experts for more tips and advice on finding the best care on 01892 335 330.

Receive a Free Care Provider Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care providers! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Annuities for care home fees: Everything you need to know

October 23rd, 2025

Learn how annuities for care home fees provide guaranteed income, financial stability, and peace of mind when planning for long-term care costs.

Older Persons Care Advice

Care options for the elderly: What is right for you?

October 17th, 2025

Discover care options for the elderly that fit your needs, from home support to residential care, helping you plan confidently for the years ahead.

Older Persons Care Advice

Are next of kin responsible for care home fees

October 17th, 2025

Find out the truth about care costs. Are next of kin responsible for paying care home fees? Learn who pays, exceptions, and how to plan ahead.

Frequently Asked Questions

Yes, it’s possible to change your ownership status through a legal process known as “severing the tenancy.” It’s often done as part of estate or care planning.

Not automatically. While it may help with control over how your share of a home is passed on, inheritance tax depends on the value of your estate and your beneficiaries.

If you’re tenants in common, your share may still be assessed for care fees, but your co-owner's right to remain in the home is usually protected.

It can be helpful, but it’s not foolproof. It's best to get personalised advice from a legal or financial expert to make sure it's right for you.