Posted by Janine Griffiths

Care Home Fees: What Happens If The Money Runs Out?

Living in a care home isn’t just about receiving the right support day-to-day – it’s also about making sure that support can continue without the added worry of financial strain. For many residents and their families, the question isn’t just how much does a care home cost? but what happens if the money begins to run out?

Understanding how care fees work and what happens if your savings start to deplete once you’re already settled is vital. Knowing your rights and the help available can make a big difference in ensuring you or your loved one can remain in a home that feels right.

The good news is you are not alone. In the UK, there are safeguards in place to make sure people can continue receiving the care they need. This is why it’s important to inform your care home if your financial situation changes, as they can guide you on next steps. At the same time, your local authority can reassess your circumstances if your savings or care needs change, which may open the door to additional support.

This blog will explore the main options available if your money starts to run low, so you and your family can feel reassured, plan ahead, and focus on what matters most: comfort, stability, and peace of mind.

Funding thresholds for care home support

If you are already self-funding your care, it’s important to know the point at which your local authority may step in to help if you run out of money. Each part of the UK has its own savings threshold, and once your capital drops below these limits set by the government you may be eligible for financial assistance (provided you meet the criteria for care needs). If you run out of money, a reassessment of your care needs and financial circumstances will be required to determine if you meet these thresholds. This applies even if you had one prior to moving into the care home.

- England – If your assets fall below £23,250, you can request a financial assessment. If you qualify, the local authority will contribute towards your care home fees.

- Northern Ireland – The savings threshold is also £23,250.

- Scotland – If you have more than £35,500 in savings, you are expected to pay for your own care. If your savings fall between £22,000 and £35,500, you’ll need to contribute part of the cost, with the local authority covering the rest. Below £22,000, the local authority should fund your care (subject to a needs assessment).

- Wales – The threshold is higher: anyone with over £50,000 in savings must pay for their own care. Below this level, the local authority can step in to help.

If your savings are running low, this is the point at which to inform your care home and contact your local authority. A reassessment can be carried out to determine whether you are now eligible for financial support, ensuring your care fees continue to be covered without interruption.

If your savings are getting close to the point where local authority support may be needed, it raises crucial questions about care home fees: what happens when the money runs out? How will the costs be met? We explore the answer to these questions in the next section.

First steps to take if the money runs out

It is natural to feel anxious when care home fees can no longer be met from personal funds, but taking clear steps can bring focus and reassurance.

If you or your loved one is already living in a care home and your savings are approaching the £23,250 threshold, be sure to request a new care needs assessment from your local authority. This is necessary because when your circumstances change, the local authority needs to establish whether you continue to need residential care and if you now meet their eligibility criteria for funded care.

Following the care needs assessment, a new financial assessment will review current savings, income, and assets to determine how much you can contribute towards care costs going forward.

It is important to contact adult social services and talk to the care home as soon as possible, ideally once your savings have depleted to below £40,000 to avoid any gaps in care funding, because the assessment process takes time.

Check the care home policy

It’s important to ask the care home what happens if savings start to run low.

Typically, this is discussed before moving in, but if you or a loved one are already in a care home and you find yourself in this situation, let the home know straight away. Many care homes will work with you and in some cases, offer support schemes to help either yourself or your loved one stay settled.

This can include invoicing the local authority directly so that you don’t have to worry about paying the fees upfront if you are no longer able to.

However, some care homes go one step further and offer additional, dedicated programs for residents with limited finances.

For example, Anchor care home group have a Resident Support Fund which helps residents pay for essential items such as food and furniture when they are low on savings. While this does not cover care fees or accommodation, it can go a long way to ensuring essential day-to-day expenses are covered when budgets are tight.

Other care groups like Greensleeves Care have a Home for Life Commitment, which means they will never ask a resident to leave if they run out of money. However, like most care homes, careseekers will need to complete a thorough financial assessment before moving into a home.

Every care home has its own approach, so don’t be afraid to ask for help with care home fees and what happens when the money runs low.

Other options to consider when money runs out

Below we explore some of the other main options available when savings run low.

Immediate Needs Annuity

An immediate needs annuity is designed for people who need a guaranteed income to cover care home fees straight away. Unlike deferred annuities, which delay payments until a later date, immediate needs annuities start paying out shortly after purchase, usually within a few weeks or as soon as administratively possible. They can be arranged even if you are already living in a care home. However, it’s important to be aware that these payments may affect eligibility for means-tested state benefits, depending on the amount received. Speaking with a financial adviser can help you understand how an immediate needs annuity could work in your circumstances.

Top up payments

If the local authority’s contribution doesn’t cover the full cost of the care home you are in, top-up payments are another option. This can be made by a family member, friend, or sometimes a charitable organisation.

Anyone making a top-up will enter into a formal agreement with the care home, so it’s important that they are able and willing to continue the payments. It’s also wise to consider that fees may rise over time, or that the person providing support could face changes in their own circumstances.

Deferred payment arrangements

There is also the option to defer payments through a Deferred Payment Agreement (DPA). This means the local authority will pay care costs now and collect repayment later - usually from the sale of the resident’s property. This is a legal contract, and to secure it, the council will place a legal charge on the resident’s home with the Land Registry. Although these arrangements are more commonly made prior to moving into a care home, DPAs can also be arranged for people already in care homes whose savings have dropped below £23,250.

To be eligible, the careseeker must own or partly own a property in the UK and have the mental capacity to enter into the agreement. Even so, there is still a possibility that funds could run out if the property’s value is not sufficient to cover ongoing care costs.

NHS continuing healthcare (NHS CHC)

If you have not already applied for NHS CHC, this can offer peace of mind if savings are running low. NHS Continuing Healthcare is a fully funded package of care for adults with a significant and complex primary health need. It is not means-tested; it is assessed solely on need. If for example, your primary need is for healthcare, you could be eligible to have all care fees covered, regardless of savings or property value. In addition to healthcare and personal care, the NHS will pay for your care home fees, including board and accommodation if you are in a care home.

This is assessed by a multidisciplinary team of health professionals. Sometimes careseekers overlook NHS CHC because the application process can be complex, but if you meet the eligibility criteria, it can alleviate the financial burden of depleted savings.

NHS funded nursing care

If you have not already applied for this, it is worth considering NHS Funded Nursing Care. This is available for those who do not qualify for full NHS Continuing Healthcare but still require the support of a registered nurse in a care home. The NHS pays a weekly contribution directly to the care home to cover nursing care costs. While it does not cover accommodation fees, it can help ease some of the financial pressure and partially relieve the burden on personal savings.

Attendance Allowance

If you or your loved one has not yet applied for Attendance Allowance, it is worth considering if savings are starting to run low. Attendance Allowance is a weekly non-means tested benefit for people over State Pension age who need extra help with personal care. The good news is that you can still claim it if you pay for all your care home costs yourself, providing valuable weekly income to help with expenses. Although this payment will not cover all of your expenses, it can certainly help take the edge off any financial hardship.

Are next of kin responsible for paying care home fees?

It’s natural to feel concerned about who will be responsible for care home fees, but in most cases, family members are not automatically liable. Liability only arises if assets are held jointly with the resident, or if a contract has been signed that specifically makes a family member responsible. Otherwise, the responsibility rests with the person that is in the care home, or - when applicable - with the local authority or NHS support programs. Next of kin can choose to contribute towards care home costs if they wish to, however, by agreeing to a third party top up fee, mentioned above.

Can you stay in the care home if the money runs out?

One of the biggest worries when savings start to run low is whether you or a loved one might have to move from the care home. Leaving a familiar place, with trusted carers and established friendships, can feel deeply unsettling.

In reality, what happens next depends on the cost of the home, the level of funding you may be eligible for, and whether the local authority agrees that the home meets your assessed care needs. If it does, your local authority should offer a choice of affordable homes. Sometimes this may include the home you are already in, but in other cases it may not.

Ultimately, the focus is always on finding a solution that prioritises comfort, stability, and continuity of care.

Looking for a more affordable care home?

If you are in a situation where you are no longer able to live in the care home you are in, Autumna makes it easy to find a care home that fits within your budget. Simply head over to the search bar on our website, select ‘Care homes’ and type in your area to view a list of suitable homes.

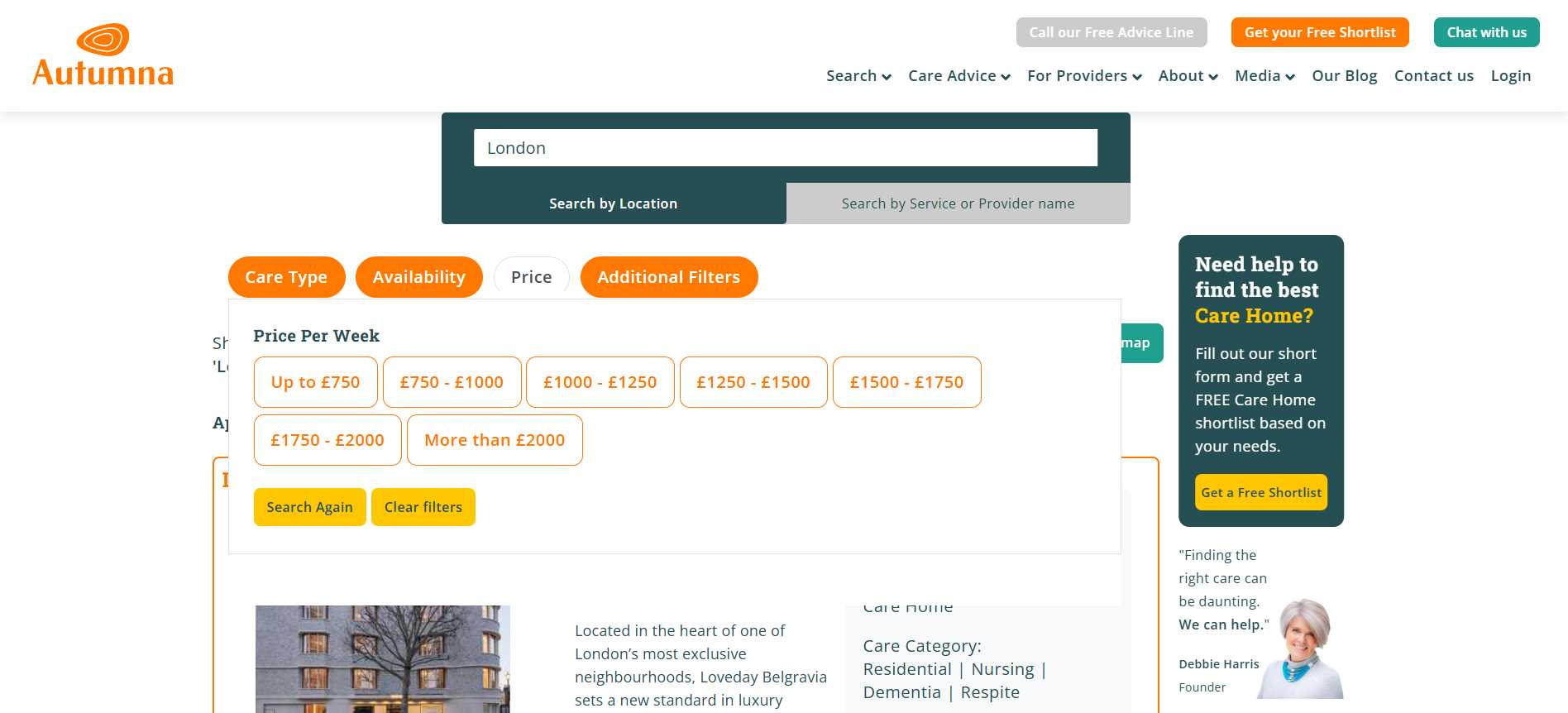

You can then use the Price filter at the top of the search results to view care homes by cost per week.

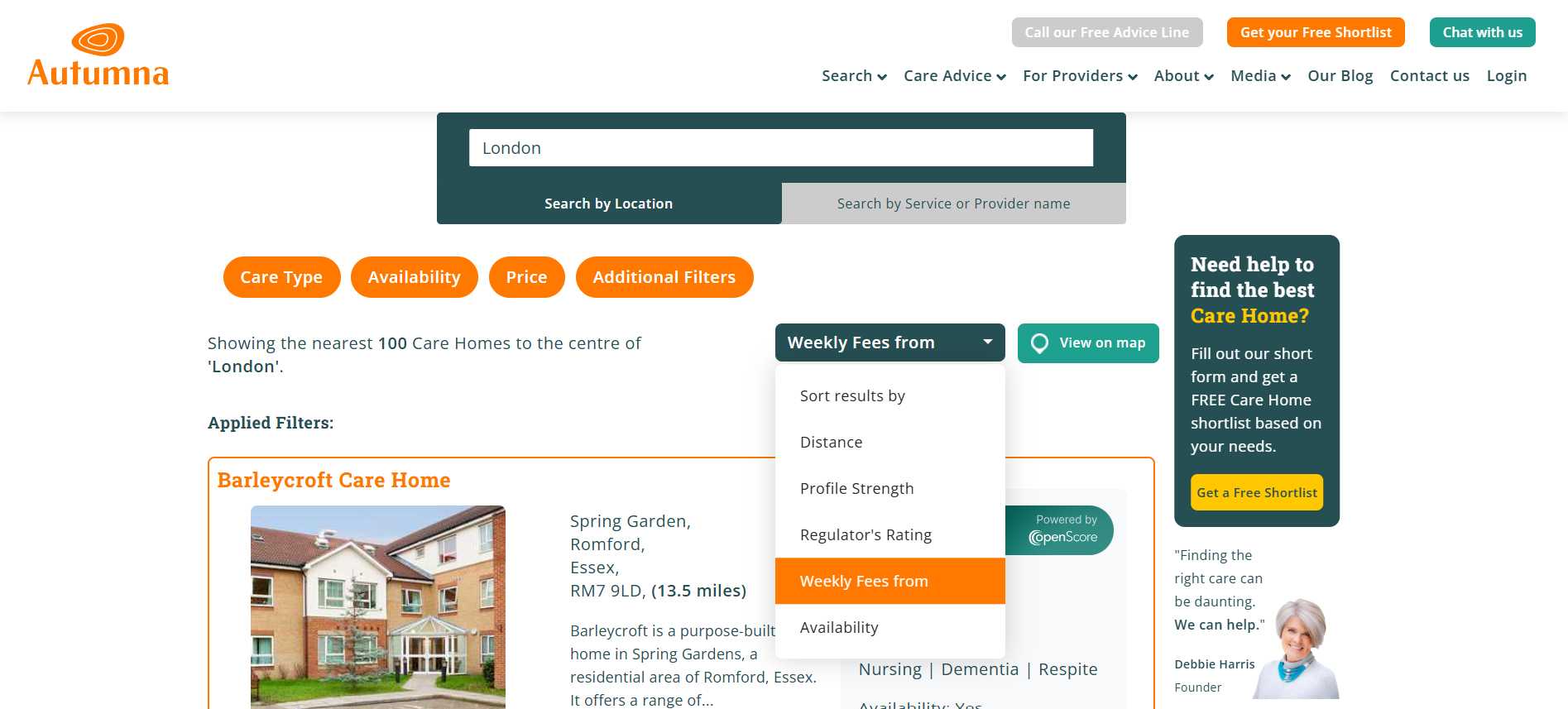

You can also sort results by ‘Weekly Fees From’ just below the orange tabs to filter results from lowest to the highest.

Alternatively, our care finding tool can do all of the hard work for you. It will prompt you with a short list of questions and then provide an even more personalised list of recommendations based on your answers. If you prefer to talk through your options, our friendly and supportive team of advisors can help. They are available 7 days a week on 01892 335 330.

Receive a Free Care Home Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care homes! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Annuities for care home fees: Everything you need to know

October 23rd, 2025

Learn how annuities for care home fees provide guaranteed income, financial stability, and peace of mind when planning for long-term care costs.

Older Persons Care Advice

Care options for the elderly: What is right for you?

October 17th, 2025

Discover care options for the elderly that fit your needs, from home support to residential care, helping you plan confidently for the years ahead.

Older Persons Care Advice

Are next of kin responsible for care home fees

October 17th, 2025

Find out the truth about care costs. Are next of kin responsible for paying care home fees? Learn who pays, exceptions, and how to plan ahead.

Frequently Asked Questions

If savings fall below the threshold, local authorities have a duty to step in for those with eligible care needs and you may be eligible for funding. Other options include NHS funding, deferred payments, and top-up arrangements to ensure care continues. It is always important to speak with your care home as they may be able to provide further advice and support.

Not immediately. It often depends whether you can find alternative funding options and how much your care home fees are. In some cases, a Deferred Payment Agreement allows the local authority to cover fees now and recoup costs later, usually from the sale of your home.

Care needs linked to dementia may qualify for NHS Funded Nursing Care or Continuing Healthcare if health needs are significant. This support can help cover fees even if personal funds are low.

The UK's largest & most detailed directory of elderly care and retirement living options

10,297

Care Homes

11,755

Home Care Services

1,669

Live-in Care Services

1,765

Retirement Living Developments

Autumna is the UK's largest and most comprehensive later-life living & elderly care directory. Our detailed search facility and team of expert advisors can help you find the best care homes, nursing homes, retirement homes, retirement villages, home care, and live-in care services for you or your loved one's needs. Our website is free to use, we are proudly independent, and we never take referral fees.