Posted by Janine Griffiths

Are next of kin responsible for care home fees

When a loved one is preparing to move into a care home, emotions often mix with practical worries, such as who will actually pay for the care?

In most cases, the responsibility for care home fees rests with the person receiving the care. Their income, savings, and assets are what determine how the costs are met. In England, for example, if they have less than £23,250 in savings, they may be entitled to help from the local authority. If they have more, they are usually expected to pay for their own care. For more information about funding thresholds in Scotland, Wales and Northern Ireland, check out our blog on care home fees.

The financial side of care can feel heavy, especially when you’re already navigating so much change. Questions often start to surface quietly - what happens if the savings run out? These worries are understandable, and they lead naturally to one of the most common concerns people share: are next of kin responsible for care home fees?

In this blog we will walk you through the answers to that question and outline the circumstances in which you might be expected to pay for your loved one’s care fees.

Are next of kin responsible for care fees?

In most situations, next of kin are not legally responsible for paying a relative’s care home fees unless they have specifically agreed to do so in writing. The responsibility usually remains with the person receiving care, whose own finances are assessed to determine how the costs will be covered.

However, there are a few situations where things can become more complicated. If you share a home or joint financial assets with your loved one, this can sometimes affect how much help your loved one receives from the local authority, depending on the type of arrangement you have. For more information on how joint ownership affects care fees check out our ‘Ultimate guide to jointly owned property and care home fees.’

Similarly, if you hold power of attorney, you may manage your loved one’s financial affairs, but that doesn’t make you personally liable for their debts. You’re simply acting on their behalf.

The only real exception comes if you’ve signed a guarantor agreement with a care home, in which case you could be held responsible for the payments outlined in that contract. And if your loved one passes away with unpaid care fees, any remaining balance will usually be taken from their estate before any inheritance is distributed.

This means that while next of kin are not personally responsible for the debt, it may reduce any inheritance that’s left behind. It’s not an easy subject to think about but understanding how it works can help avoid surprises later on down the line.

Understanding these distinctions can offer real peace of mind. It means families can focus on supporting their loved one emotionally, without the added fear of unexpected financial pressure.

Will you be forced to sell your parents’ house?

If your loved one's other savings are low, but they own their home, the following options may be available to you:

Deferred Payment Agreement

One common route is a Deferred Payment Agreement. This is an arrangement with the local council where they essentially lend you the money to cover the care costs. The council will later claim this money back, with interest, from the sale of the house or after your loved one has passed away. This allows the property to be sold in its own time, rather than in a rush to meet fees.

Top up fees

Another possibility is the use of top-up fees. This is when a family member, or sometimes a charity, voluntarily agrees to pay an additional amount each week to cover the cost of a more expensive care home than the local authority would usually pay for. It is a personal commitment, and it is crucial you only agree to this if you are certain you can afford it for the long term.

While you are not personally liable, you can play an active role in managing the solutions available, helping to protect the home and the legacy within it.

Transferring home ownership to avoid fees

Some people consider transferring ownership of a home to avoid care fees. This is often called deprivation of assets, and it is something authorities take seriously. Even if a property changes hands, the individual moving into care could still be held responsible for fees if it is determined that the transfer was made to deliberately reduce their wealth.

It is also important to remember that if local authority funding has already been received, the money may need to be repaid.

For information on how to avoid paying for care fees legally, check out our blog, ‘how to avoid care home costs.’

Hints and tips when paying for care fees

Paying for care can feel overwhelming, but taking a few careful steps can make the process clearer and less stressful.

Review any paperwork carefully

It is essential to review any contracts, agreements, or guarantor arrangements closely. These documents often contain key details about who is responsible for payments and under what circumstances, which can prevent misunderstandings later. Open communication with the care home is equally important. Discussing any difficulties or concerns as soon as they arise can lead to solutions that avoid unnecessary stress.

Seek professional advice

Always aim to get financial advice before making decisions about care provision.

Seeking professional advice from organisations such as the Society of Later Life Advisers (SOLLA) can provide guidance tailored to your situation and help you understand your options.

Looking for affordable care?

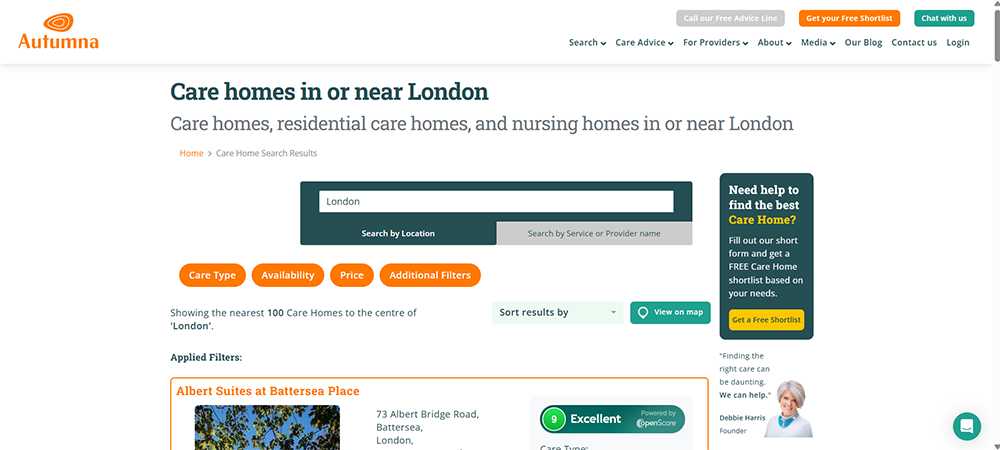

Autumna’s directory can make it easier for you to explore options which allows you to compare facilities at your own pace. Simply head over to our homepage, type in your location and press enter.

You will then see a list of results at the top of the page. The orange tabs above the results, allow you to filter care homes by price.

Filtering by price helps narrow down choices so you can focus on what is financially manageable without compromising quality.

Alternatively you can use our shortlisting tool, that can match you with an even more personalised list of providers. If questions arise or guidance is needed, our dedicated team of advisers are available seven days a week ensuring support is never far away. You can contact them on 01892 335 330.

Receive a Free Care Home Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care homes! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Care options for the elderly: What is right for you?

October 17th, 2025

Discover care options for the elderly that fit your needs, from home support to residential care, helping you plan confidently for the years ahead.

Older Persons Care Advice

Are next of kin responsible for care home fees

October 17th, 2025

Find out the truth about care costs. Are next of kin responsible for paying care home fees? Learn who pays, exceptions, and how to plan ahead.

Older Persons Care Advice

How to find a live in carer

October 15th, 2025

Discover how to find a live in carer who’s skilled, trustworthy and compatible, with practical tips on choosing the right support for your needs.

Frequently Asked Questions

Usually, no. Next of kin aren’t legally required to pay unless they’ve signed a guarantor agreement or similar contract.

If their savings fall below £23,250, the local authority may help with funding based on financial assessment.

No having power of attorney means managing finances on their behalf, not taking on personal liability for fees.

Not necessarily. Deferred Payment Agreements or top-up fees can delay or reduce the need to sell immediately.

The UK's largest & most detailed directory of elderly care and retirement living options

10,330

Care Homes

11,863

Home Care Services

1,663

Live-in Care Services

1,754

Retirement Living Developments

Autumna is the UK's largest and most comprehensive later-life living & elderly care directory. Our detailed search facility and team of expert advisors can help you find the best care homes, nursing homes, retirement homes, retirement villages, home care, and live-in care services for you or your loved one's needs. Our website is free to use, we are proudly independent, and we never take referral fees.