Posted by Janine Griffiths

Annuities for care home fees: Everything you need to know

When the cost of long-term care begins to rise, it’s natural to wonder how long your savings will last and whether you’ll be able to stay in a care home that feels right for you. For many self-funders, purchasing an annuity for care home fees can offer financial stability.

An annuity can provide a guaranteed income for life, helping to cover care costs and bring some peace of mind. But with several different types of annuities available, it can be hard to know whether an annuity is right for you and where to begin.

In this article, we’ll explore what annuities are, the various options available, and how they can help you or a loved one plan confidently for care.

We’ve also spoken to Mel Kenny, an accredited adviser from the Society of Later Life Advisers (SOLLA) to share expert insight on how to make the right choice for your circumstances.

What is an annuity?

An annuity is a financial product designed to provide you with a regular, guaranteed income in exchange for a lump-sum payment. In simple terms, you pay an insurance company a one-off amount, and in return, they agree to pay you a steady income either for a fixed period or for the rest of your life.

Annuities are often used as part of retirement planning or to help cover ongoing expenses - such as care home fees. For people entering long-term care, an annuity can provide peace of mind that essential costs will always be covered, no matter how long they live.

The key appeal of an annuity is security: unlike investments that can rise and fall in value, an annuity guarantees a consistent income stream. This can make budgeting for care much easier and reduce the financial worry that often comes with growing older.

What to consider before getting an annuity

Before deciding on an annuity, it’s worth taking time to reflect on what matters most to you. Annuities for care home fees can provide stability and peace of mind, but they also require careful thought. Your health, your finances, and how much certainty you want over future care costs all play a part in finding the right option. It’s not only about securing income; it’s about ensuring that your later years feel supported and manageable.

Advantages of annuities

Annuities offer a unique combination of financial security and peace of mind, especially when planning for long-term care.

According to Mel, one of the key strengths of annuities is the reassurance they bring. He said: “Rather than continuing to pay the care funding shortfall using savings in the bank, annuities can contain the cost of care. In exchange for a lump sum, an insurer can provide guaranteed income to cover the care funding shortfall, no matter how long the person receiving care lives. These are called immediate needs annuities, and there are also deferred annuities for care plans that start later.

“The income generated is also paid tax-free so long as it is paid to a care provider that is registered with the Care Quality Commission. These types of plans can provide peace of mind that money will not run out, which means that you can avoid becoming reliant on what the local authority might provide.”

By converting a lump sum into a reliable income stream, annuities can help people focus on care rather than finances, ensuring that funds are protected for the long term.

Once in place, they provide a guaranteed income that continues no matter how long you live. This consistency can lift a weight off your shoulders, removing the fear of running out of money for care. This stability can make a real difference, providing confidence and control in what can otherwise be a stressful and uncertain situation.

Disadvantages of annuities

However, annuities are not suitable for everyone. Once purchased, they are usually fixed, meaning you can’t change your mind or access the lump sum for other purposes later. The income may also stay the same, even as the cost of care rises. Some people find this lack of flexibility difficult, particularly if their circumstances change. It’s also important to remember that the overall value you receive will depend on how long you live, so for some, it might not feel like good value.

What are the different types of annuities

Now that you understand what an annuity is, let’s look at the different types available. Each one works in its own way, offering different levels of flexibility, security, and value. Knowing how they differ can help you find the right fit when considering annuities for care home fees.

Pension annuity

A pension annuity is one of the most familiar types of annuity in the UK. It’s purchased using money built up in your pension pot and provides a guaranteed income for life or for a set number of years. For many people, it offers security after decades of saving and working hard. When considering annuities for care home fees, a pension annuity can play an important role in providing a steady income to help cover care costs once you retire. It can take the worry out of managing complex investments and offer a reliable foundation of income when stability matters most.

Investment linked annuity

An investment linked annuity works differently from a traditional fixed-income option. Instead of paying a guaranteed amount for life, your income is linked to the performance of underlying investments such as stocks or funds. If the investments perform well, your payments can grow over time. If they perform poorly, the income may fall. This type of annuity carries more risk but can offer the chance of higher returns, which may help keep pace with rising care costs. For those considering annuities for care home fees, an investment linked annuity might appeal if you’re comfortable with some uncertainty in exchange for potential growth and long-term value.

Lifetime annuities

A lifetime annuity provides a guaranteed income for the rest of your life. It removes the uncertainty of how long your savings will last and can offer reassurance that your care costs will always be covered.

Joint lifetime annuities

A joint lifetime annuity continues to pay out until both individuals named on the policy have passed away. It can be a comfort for couples who want to make sure that, no matter who needs care first or lives longer, financial stability is maintained.

Enhanced annuities

An enhanced annuity pays a higher income if your health or lifestyle means your life expectancy may be shorter. Health conditions or specific circumstances can make you eligible for a better rate, meaning your money could stretch further in later life.

Immediate needs annuities

An immediate needs annuity is specifically designed for those already in, or about to move into, a care home. The income begins straight away and is usually paid directly to the care provider. It’s a straightforward way to ensure your care fees are consistently met.

Deferred annuities

A deferred annuity begins payments after a set period rather than immediately. It can be useful if you’re planning ahead and want future care costs to be covered at a later stage in life.

Variable annuities

A variable annuity links your income to investment performance. Your payments can rise or fall over time depending on how the investments perform. It carries more risk, but it can also offer potential for higher returns.

Purchased life annuities

A purchased life annuity is bought using money that has already been taxed. Because of this, part of each payment is treated as a return of your original capital, which can make it more tax-efficient.

Each of these options offers something different, and the right choice depends on your health, priorities, and how you wish to manage your finances in later life. Understanding these distinctions is an important step toward making a confident, informed decision about annuities for care home fees.

Is an annuity right for you?

Whether an annuity is right for you depends on your circumstances. For some, the idea of knowing their care costs are covered brings real comfort. For others, the thought of locking away a lump sum or receiving set payments feels restrictive. There isn’t a single right answer, only what’s right for your life and peace of mind.

Mel Kenny, a SOLLA adviser, explained: “Typically, it’s right for people who want peace of mind, who want to be hands-off, and where the person requiring care has a relatively stable health outlook.

“It’s not a case of just going out and buying an annuity - you have to go through a financial adviser, because it’s a complex arrangement that may not be right for everyone. Advice is required.”

How often will you receive payments?

The answer depends on the type of annuity you choose and the insurance company you go with, but the good news is that the schedule is predictable and dependable.

Some annuities provide monthly payments, while others may pay quarterly or annually. Regardless of the schedule, the key is that the income is guaranteed for as long as you need it. This reliability means you can plan your finances with confidence, without worrying about gaps in funding or unexpected shortfalls.

Having a consistent, guaranteed income stream removes the uncertainty that so often comes with long-term care. It means your focus can remain on living your life with dignity and comfort, knowing that the practicalities of paying for care are taken care of.

Looking for an affordable care home?

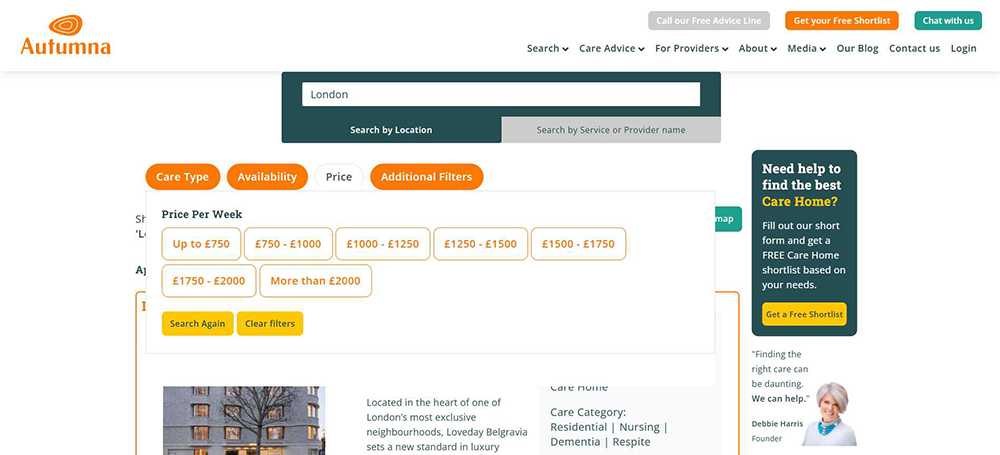

Autumna makes it easy to find a care home that fits within your budget. Simply head over to the search bar on our website, select ‘Care homes’ and type in your area to view a list of suitable homes.

At the top of the search results you can find the Price filter to view care homes by cost per week.

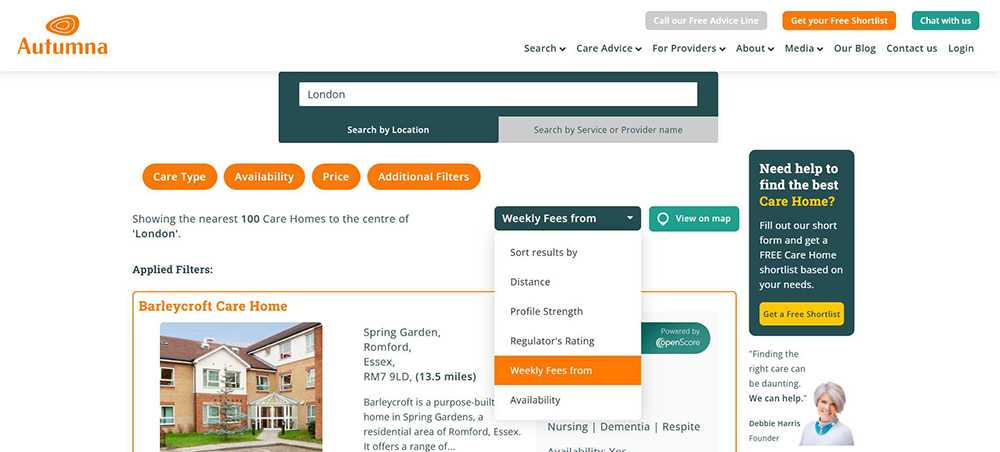

You will also be able to sort results by using the ‘Weekly Fees From’ filter located just below the orange tabs to filter results from lowest to the highest.

Alternatively, our shortlisting tool can do all of the hard work for you. It will prompt you with a short list of questions and then provide an even more personalised list of recommendations based on your answers. If you prefer to talk through your options, our friendly and supportive team of advisors can help. They are available 7 days a week on 01892 335 330.

Receive a Free Care Home Shortlist!

Let our expert team of advisers get your search off to a great start.

Tell us a little about your needs and we'll send you a bespoke shortlist of care homes! Click the button below to begin, it takes just a few minutes.

Other articles to read

From the blog

Older Persons Care Advice

Annuities for care home fees: Everything you need to know

October 23rd, 2025

Learn how annuities for care home fees provide guaranteed income, financial stability, and peace of mind when planning for long-term care costs.

Older Persons Care Advice

Care options for the elderly: What is right for you?

October 17th, 2025

Discover care options for the elderly that fit your needs, from home support to residential care, helping you plan confidently for the years ahead.

Older Persons Care Advice

Are next of kin responsible for care home fees

October 17th, 2025

Find out the truth about care costs. Are next of kin responsible for paying care home fees? Learn who pays, exceptions, and how to plan ahead.

Frequently Asked Questions

They provide guaranteed income for life, ensure care costs are always covered, and bring peace of mind and financial stability in later life.

You pay a lump sum to an insurer, who then pays a regular income (often tax-free) directly to your care provider for as long as needed.

Not always. They’re ideal for those seeking security and peace of mind but may not suit those who want flexibility or access to their lump sum later.

Yes. A qualified later-life adviser (such as a SOLLA-accredited one) can help assess your health, finances, and goals to find the right plan.

The UK's largest & most detailed directory of elderly care and retirement living options

10,319

Care Homes

11,800

Home Care Services

1,666

Live-in Care Services

1,761

Retirement Living Developments

Autumna is the UK's largest and most comprehensive later-life living & elderly care directory. Our detailed search facility and team of expert advisors can help you find the best care homes, nursing homes, retirement homes, retirement villages, home care, and live-in care services for you or your loved one's needs. Our website is free to use, we are proudly independent, and we never take referral fees.